Post Views: 5,733

DSC means Digital Signature Certificate it is a signature in electronic form, nowadays DSCs are used for many things like applying for GST registration, PF registration, income tax etc. The DSC is equivalent to the physical signature and therefore acceptable in almost all government bodies. In the case of GST registration as well as GST return filing it is important to register the DSC on the GST portal. Here we discuss the procedure to register DSC on the GST portal for the first time of registration.

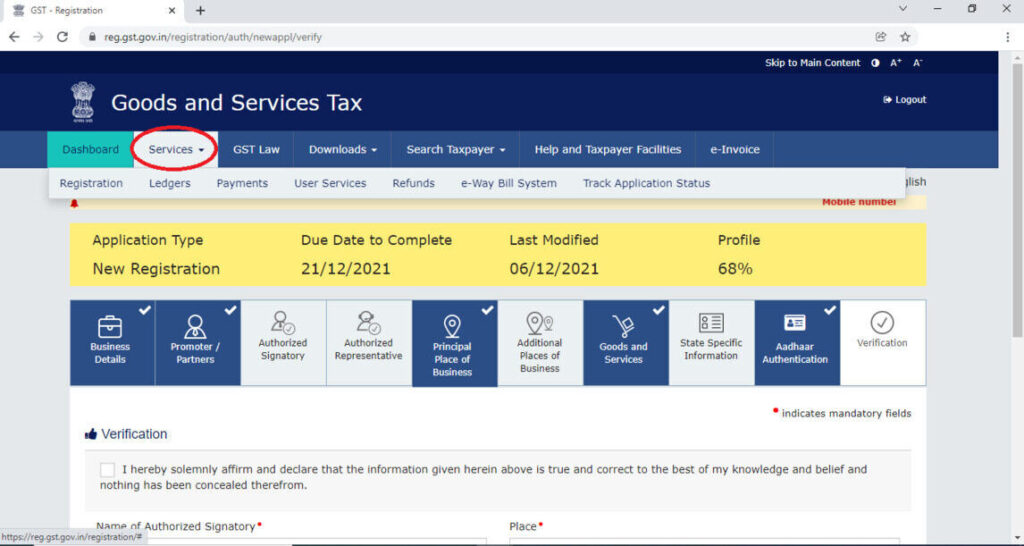

- After filling all the forms then insert the DSC token in your system and go to the option “SERVICES”

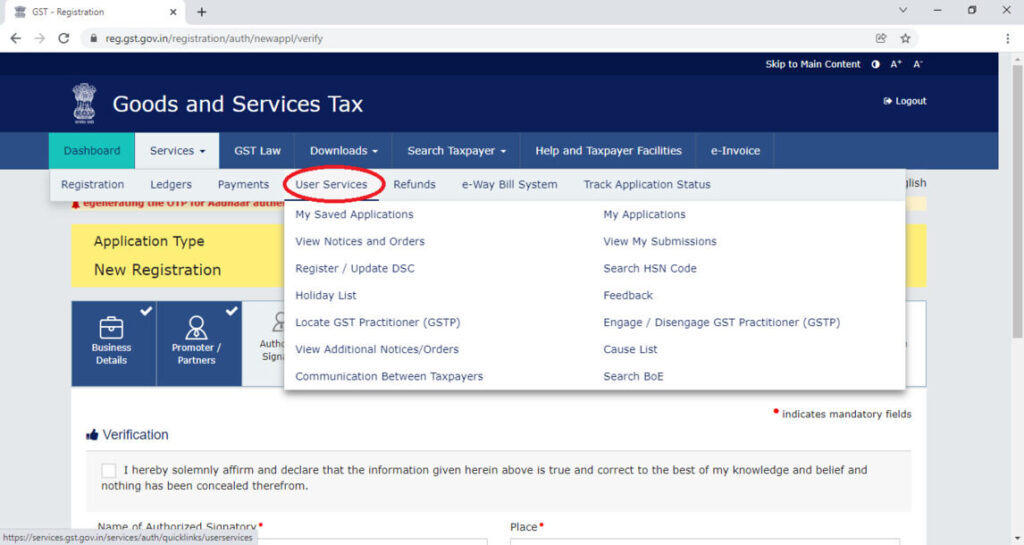

- After going to the option “Services” then go to the “User Services option”

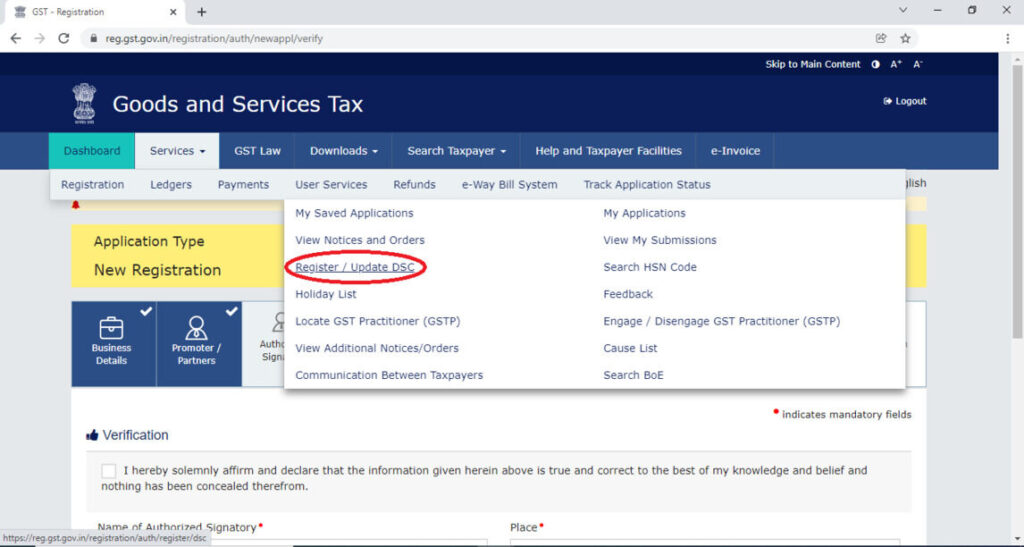

- Here many options will be open but we have to click on “Register/Update DSC” option

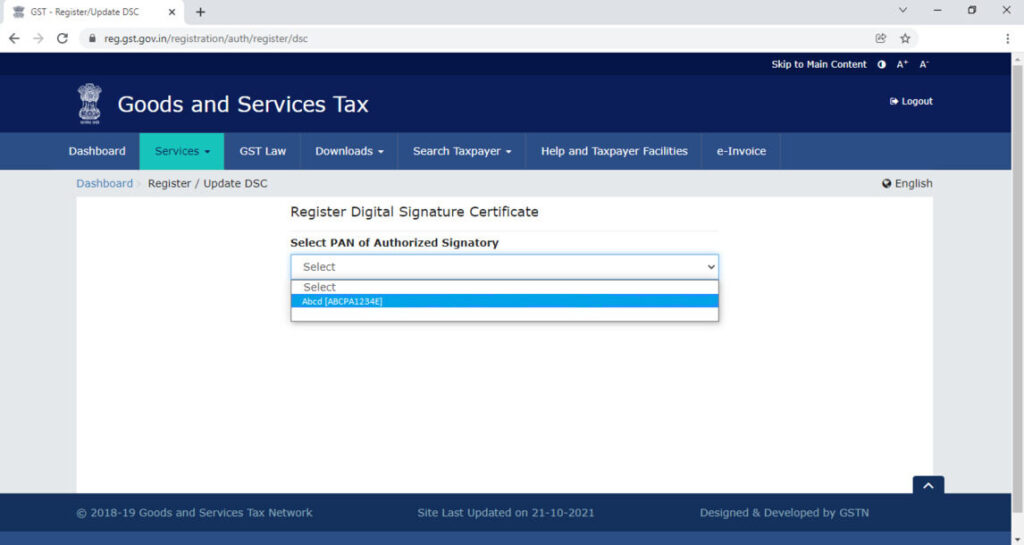

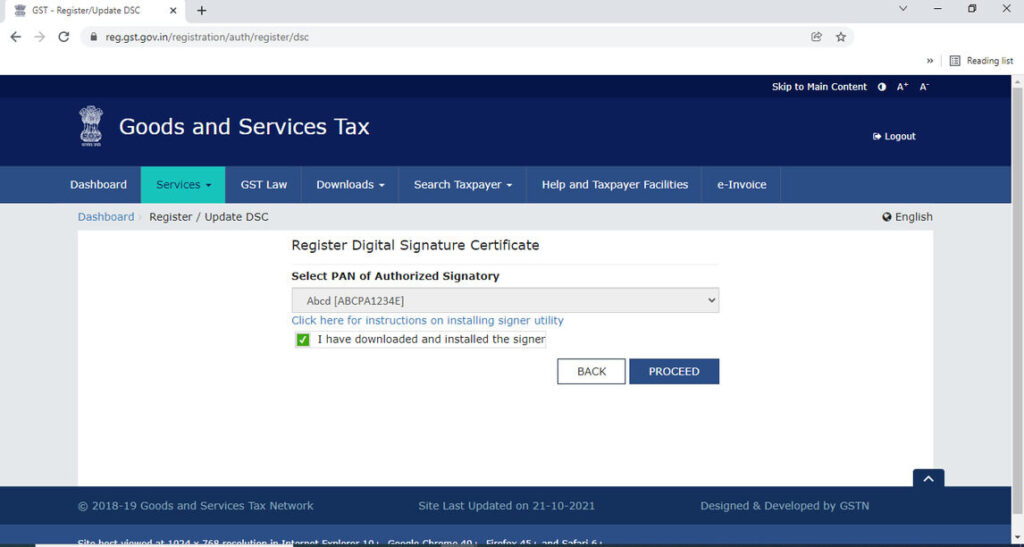

- After clicking this option there will be a page appear in which you have to select the authorized signatory to register his DSC

- After selecting the authorized signatory >> select the box given

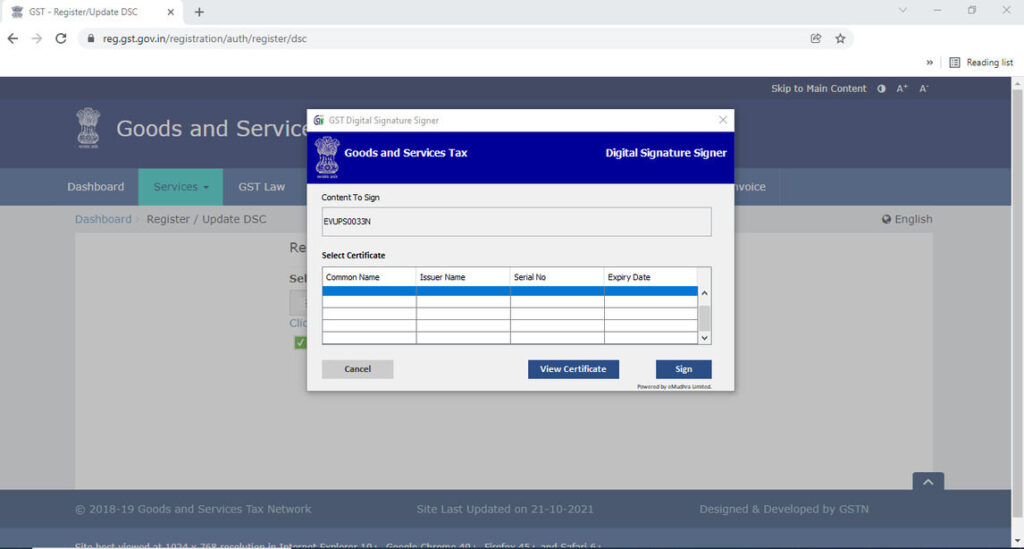

- Then go to the proceed option and select the authorized signatory name and sign it.

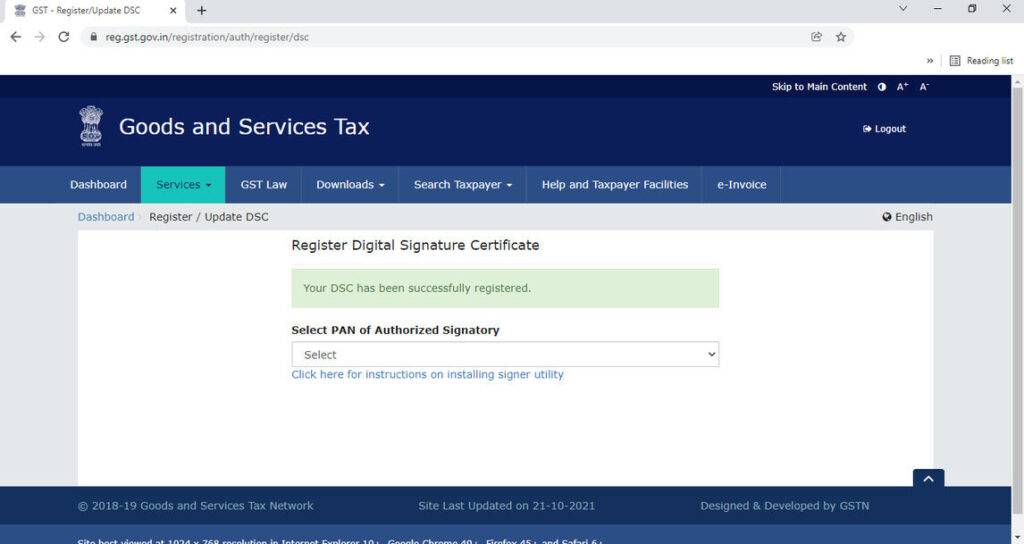

- After entering the password your DSC will be registered with the GST portal

- Now you can file your GST application by DSC

Still Confused? Talk To Our Experts

GOOGLE RATINGS 4.8/5

4.8/5

GET FREE CONSULTATION!

LEAVE YOUR DETAILS

GST Return Filing. Get CA/CS Assisted Services