The GST department comes with a new notification on 29th June 2021, in this provided the functionality to check the misuse of PAN in GST registration. The government has introduced a function on GST Portal under which the applicant can file the complaint, it will help the officer in enquiry and cancellation of GST registration and also help in preventing fraud and misuse.

The process to register the complaint is as follow:

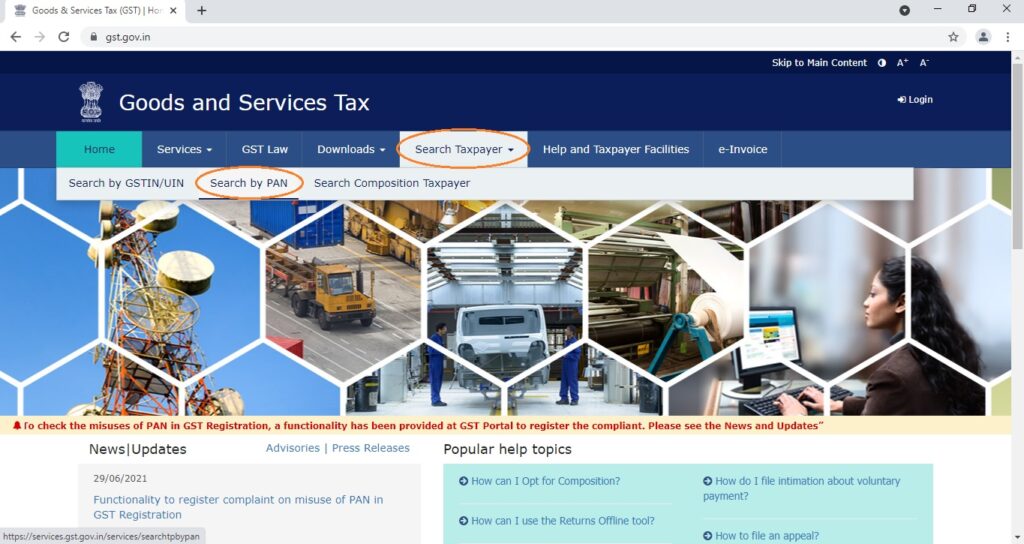

- The applicant can search the application by using PAN, that whether GSTIN allotted or not on this PAN. Go to the GST official website and then go to Search Taxpayer and then Search by PAN.

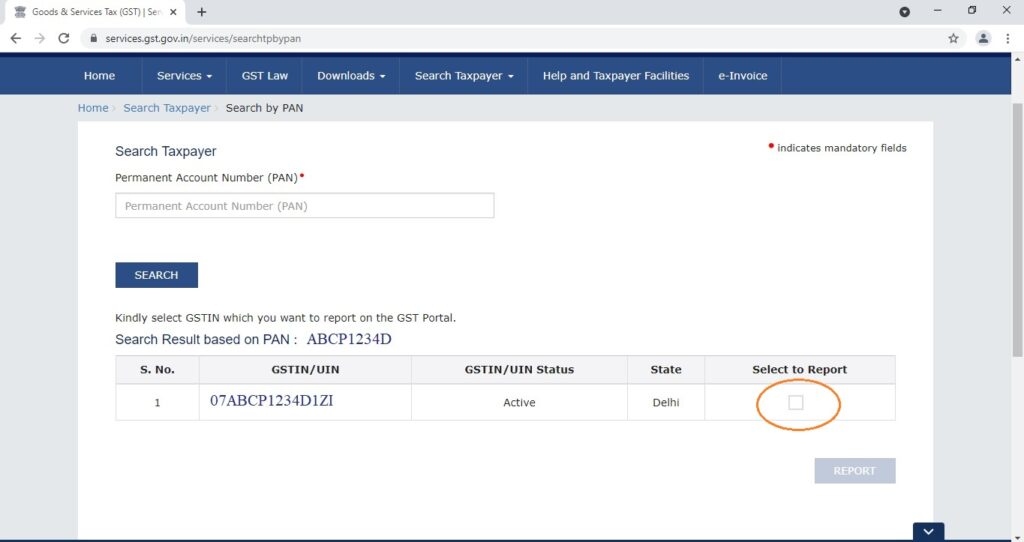

- The number of applications will be displayed on the screen and if there is no registration then on-screen “No Record Found” will be shown.

- If any person is aggrieved that his/her PAN is used for multiple registrations then he/she can file the complaint by selecting the “Report” option

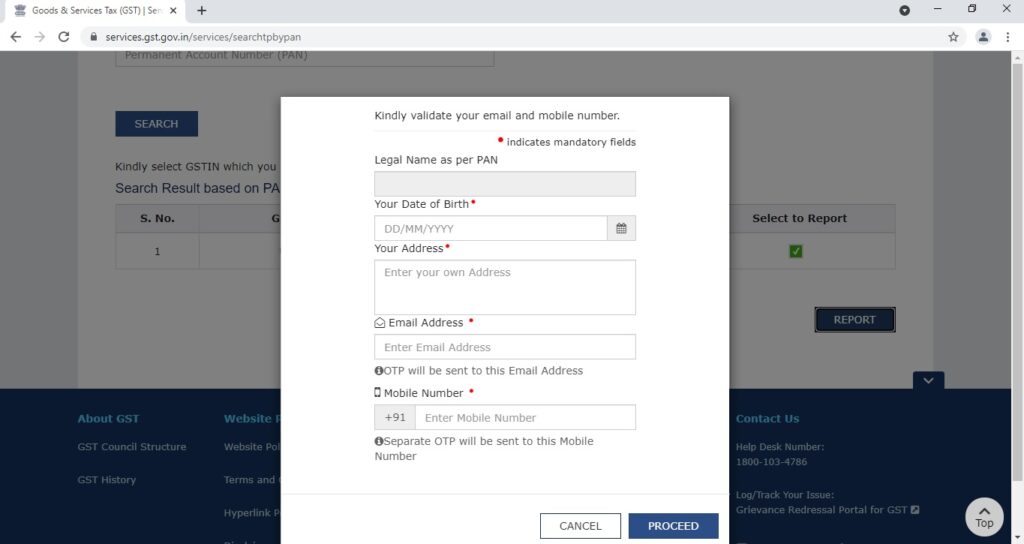

- After clicking report fill in all the required details like date of birth, address, email id and mobile no. and click the proceed button then enter OTP.

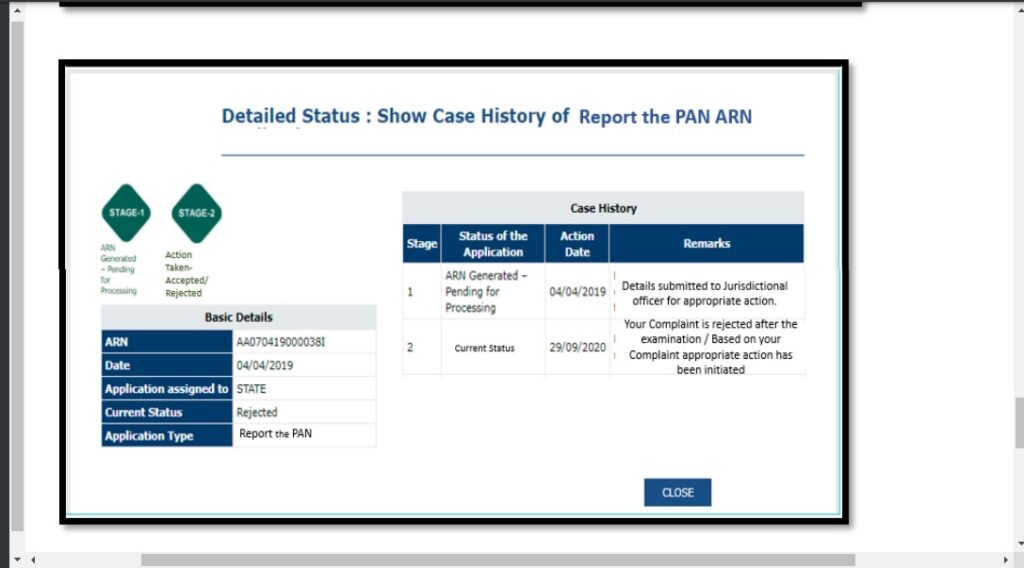

- Once the complaint request is submitted the ARN will be generated and in case of multiple GST numbers, then different ARN will be generated in respect of each GST number. Now the request of this will be assigned to the respective jurisdictional officer for further necessary action. The applicant can track the application status by using the ARN

- After examination, the officer will reject the other applied GST number if they are obtained falsely.

This complaint can be filed by any person whether it is an individual or any Company like Private limited company or Public limited company or LLP or any other entity. The government came up with this feature only to protect the misuse of the PAN for GST registration.

Still Confused? Talk To Our Experts

GET FREE CONSULTATION!

GST Return Filing Starting @ Rs 200 Per Month. Get CA/CS Assisted Services